CLIFF NOTE: POUND to attack 1.7, make it thru and then set up for a SHORT. If it does not break thru, then waiting for a sell pattern. Am NOT going to try and count the current consolidation. If/when it makes it thru 1.7 it will be quite the cookoff!

CLIFF NOTE 2: please see the following link and you’ll see that my “triangle” thesis in the POUND was, well, wrong … it’s been over 3 months since I have looked at it. Took that long to bring a fresh perspective. I can still tell you that I am waiting for a PATTERN but I’m not tied to the triangle anymore …

the first thing I am going to do is go back a 100 years … I should go back further but 1) it’s the weekend and 2) believe this is accurate. While it’s true the Pound wasn’t necessarily floating against the dollar til 1971 I want to remind us that Spot Gold stopped on the .382 from the early 1900’s and it was fixed then also. So, here’s a long term count POTENTIAL from 1915

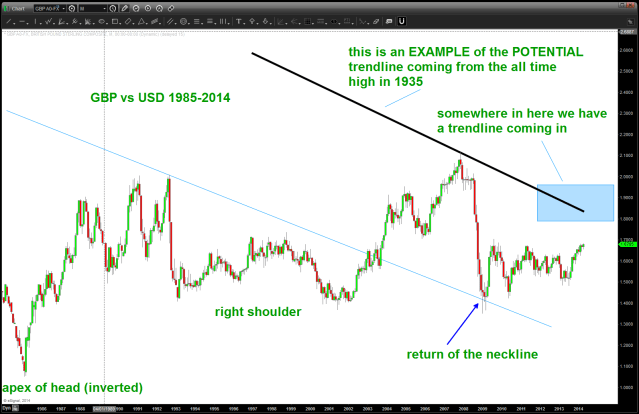

here’s a POTENTIAL look at the BIG PICTURE (note it’s not EXACT) but a quick look at some major trendline POTENTIAL

note the inverted head and shoulders pattern present and how the 2007-2009 THUMP came right back down to the trendline and STOPPED. Folks, that’s BULLISH … basic TA says to WAIT for the neckline break UP or DOWN on a H+S patterns and for price to “come back to the neckline” — that’s what happened…

So, now let’s “zoom in” to a MONTHLY look at the GBP ….

some things to notice – 1.4 is a BIG DEAL from a support perspective and the 1.70 handle has been key since 1996 as RESISTANCE and support. I think it’s inevitable that we are going to go up and attack 1.7.

let’s digest two major points:

1. so, believe a case can be made of the inverse head and shoulders and the return to the neckline as shown below. (note: these trendlines are not exact but are used to give us a sense/feel of where are.) Our light blue line is the neckline of the inverted head and shoulders and illustrating how we “returned to the neckline” and bounced. Now, let’s think about it for a moment — if you can remember back to 2009 the financial world was coming unglued. So, take a look at the candles coming into this low. THEY ARE VERY BEARISH and the NECKLINE HELD. Overall — bullish ….

2. I do not have the chart data that goes back 100 years. I have used the chart above to make a BEST GUESS ESTIMATE of the trendline coming from the all time high in 1935 up in the 5.xxx’s. What we can say is this trendline is going to come into play. If I can get my hand on a good CQG chart or something like that THEN I could get more exact but it’s something to understand. There is MAJOR resistance on the POUND higher but the fact that the data isn’t as good as I would like it “could be” a 300-500 pip range. Way to much to manage risk … but be aware.

now that we have defined the key areas we can also get a “feel” by using the long term RSI support and resistance zones

what do we see ? In the long term picture there have been times where it has bounced off BULLISH support in the 40-50 area but it has NEVER broken thru the BEARISH resistance levels defined by Constance Brown.

so, note sure I am any farther along then when I started but I do think I have put together an executable gameplan. Let me know what you think ….