Tag: $slv

Silver .. now this is a ‘monster wick’ which is bullish …another run up beginning?

Silver and the Sun King

always enjoyed this song … the Sun is kind of cool.

if your going to study this chart below then also spend some time doing a quick search of “SILVER” on http://www.bartscharts.com ….14 level is a BIG DEAL based on patterns …here’s the link:

http://bartscharts.com//?s=silver

feeling pretty confident we have started a really really strong short squeeze LONG silver play in a C wave that’s going to go higher than anyone is expecting …

why the “Sun King” reference?

well … it’s usually a good thing to keep track of the Sun and it’s position relative to where it is in the zodiac. In this case, we bottomed at 14 on December 01, 2014 and the sun was located at 249 degrees geo. (earth centered). IF we move the sun 249 days from that low we get (missed by a day) the recent low in Silver. I know, I know it’s all “voo doo” and “chicken bones” and it doesn’t make any sense. Ummmm, yup.

Also, note that his PATTERN had 1.05946*ab = cd and it landed on the .9438 retracement. (1/1.05946 = .9438) Monstrous sentiment against the metals, the LOW had not been taken out and a PATTERN. Throw some “sun king” in there and well, let’s all take a ride on the Yellow Submarine …

ROCK ON, OK?

Bart

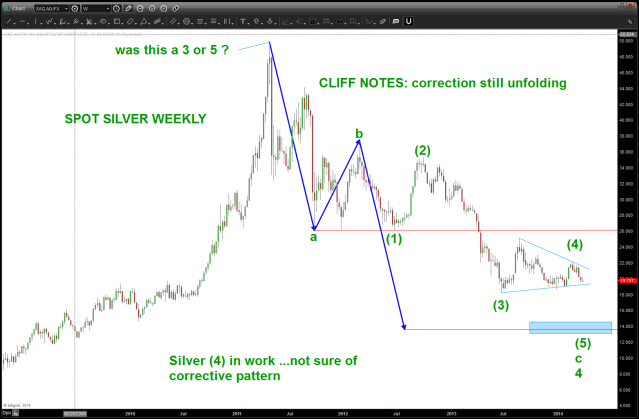

Silver Roadmap Continued – getting tricky

if you go to @seeitmarket and also “search” Silver on this site you’ll see we have been watching inflections at 8/0z and then 48 oz and, most recently, the low that came into 14/oz.

conversation has been around a “big low” at 14 and potential new highs OR a corrective bounce. at this point in the game, it’s still an uncertain aspect of the Silver move BUT the odds are leaning to the side of the “correction” fence.

I’ll present three scenario’s for Silver. Right now, it appears the A-B-C correction is the most favorable to monitor …

#1: CORRECTION: If you look at the most recent high of 18.40 you’ll see it made that high from 14 in a corrective 3 wave bounce. In “counting waves” the correction that is occurring from 18.40 high is not ALLOWED (it’s a rule) to go below wave 1. (It has done that as the HIGH for wave 1 would have been 17.20.) So the current move can be counted as B w/ 5 wave C to begin here or a little lower. If we are in a flat type of correction prices could go all the way back down to the low or a little lower BUT ultimately we should feel confident that a 5 wave move UP will be occurring.

#2: BULLISH MOVE: in this case, note the slight change in the count. What we can safely say is that for this count to be valid prices can NOT go below the red line. IF they do THEN it’s apparent we are in the A-B-C correction. the count below is EXTREMELY BULLISH in that we’re making the case that this wave is subdividing and is going to be very strong. Prices basically need to hold right here and go up w/ a vengeance. Odds are not favorable for that right now. We will see ….

#3: BEARISH BEARISH BEARISH: I don’t like this, but I have to show it simply because the COUNT coming into the 14/oz low was pretty spot -on so the TIME of the correction is, simply, not in line w/ that count. Additionally, note the THRUST up out of the 14/oz level. But, alas, I need to show it.

First off – note on the daily w/ do away w/ the thesis that it was a triangle that proceeded the 14/oz low. (Editors comment (me): folks that triangle was a PERFECT a-b-c-d-e so it’s hard for me to show “no triangle” but need to show to be objective) Now, note the wave structure which subdivides and doesn’t break any RULES. This forecasts another “new” low before move UP in earnest.

Out of the 3 options present I lean toward #2, then #1 and then, finally, #3.

Let me know if you have any questions.

Make it a GREAT weekend.

Bart

Gold and Silver Update ….and some more of the metals

CLIFF NOTES: a case is made, below, that inflection points in the ratio of GOLD/SILVER cause big movements in the spot gold and silver prices. Also, it appears that Gold lags. We are at a resistance level which “might” be one of those inflection points so expect the metals to get moving NOW or SOON. Probability points “lower” across the board for the metals.

Ratio Analysis – we love using the patterns w/ ratio analysis and, of note, is the noticeable strength in Gold vs Silver the past couple weeks. So, our first chart is going to be the relative strength of spot gold / spot silver. Basically, when the candles are going DOWN then SILVER is “stronger” and when the candles are going up GOLD is “stronger.” After looking at this chart one thing stood out … it really didn’t matter which direction the relative strength ratio was moving, but when the ratio shifted and one of the assets noticeable started to our perform or under perform THEN we had an inflection point in silver. Below you will see a set of three charts showing you the PATTERNS that were present in these ratio’s which, if we knew about them, might have helped us position ourselves – based on other patterns and technical factors — on the long or short side of the spot silver or spot gold market or both.

so where are we now …? Just using basic measured moves we can see that EVERY move in this ratio has been “used” before so our trick is to find out which one might work or not. Note the downward blue and orange arrows … then note the crash and how the vectors were almost perfect. so … we “should” do either the black or the purple measured move UP –right? note we are at the .618 of the gold/silver ratio and the black arrow would take us up to the .786. One of those two levels “should” hold and cause an inflection in the ratio. See below:

so – now that we can see resistance ahead, has the ratio really helped pinpoint inflection points?

what about Gold? Well, take a peak … the key thing I see is that while it’s not as “precise” from a timing perspective it appears that GOLD LAGS THE INFLECTION IN THE RATIO …

here’s the daily:

Now, let’s take a look at the metals individually. Folks, below is a great chart .. it shows the pegged price of gold from 1913 and, guess what, roughly 1200 is the .382 retracement. So, in the context of this long run in gold prices (100 years in the making) Gold is holding the .382 retracement which is EXTREMELY BULLISH. So, if you don’t believe me here’s the chart:

if we do break that level – look for 950-1000. Spot silver – sticking w/ my guns here and a buy at 14.

Copper – folks, still sticking w/ a MAJOR 5 wave move in copper complete. More to the downside and, remember, how FXI (China) likes/mirrors copper ….

Silver Update July 2014

CLIFF NOTES: the move up since early June went higher than expected and, for the first time since the low at 8 I have to reevaluate if a low is in place or we will go down to my long standing 14/0z. so, in order to do that and to watch in real time as we figure this out I’ve included two charts. right now I would like this pullback to test the 19-20 area. If it holds and starts UP strong then the 14 might not be tested….however, if we break that level w/ ease or w/out much of a test then 14 is open.

either way, if we do not get down to the 14 level the KEY is going to be the shelf at 26.70.

apologize for the “wishy washy” nature of this one …the PATTERN completes at 14 but it doesn’t “have” to go there …

stay tuned

Ten charts that prove Technical Analyis is valid and PATTERNS exist and give you an EDGE

CLIFF NOTES: in Mark Douglas’s amazing work, on page 132 of Chapter 8 he defines an edge as “nothing more than an indication of a higher probability of one thing happening over another.” My edge is pattern recognition based on square roots and the inverse of those square roots. As my friend and mentor Larry Pesavento (www.tradingtutor.com) said “defy the human condition and do the work.” If you spend as much time as I have in front of charts you’l find that in the midst of the chaos there is patterns that appear and they give you an edge.

My exemplar below is, simply, silver and the PATTERN that existed from $8.00 to 50 and then back down and the PATTERN that is now coming into play at/around 14. What does this mean? Well, see above – it mean it’s an edge and it might hold and, then again, it might not.

All of these charts are real time w/ ZERO “could of, would of, should of” … the PATTERNS work, technical analysis works and get ready to rumble at 14/oz.

ROCK ON, ok?

Silver and 14/oz

Silver update …

for review, here’s the past Silver work …

http://bartscharts.com//?s=silver

CLIFF NOTES: complex correction unfolding in (4) – waiting for the 14 level to BUY on Silver. $$$$ question – was the high up in/around 50 a 3 or 5? Not sure..either way 14 is a pattern.

I love this chart …

the WX in Northern Virginia today is just down right ugly … snow, winter mix, wind has picked up. Have been doing posts, checking on the wife w/ a herniated disk and the 9 year old w/ a sinus infection and then playing Pink Floyd looking for patterns. As I was going thru the charts I realized 1) I have saved way too many of them … and 2) there are some amazing ones out there …

here’s a chart that simply shows the aftermath of parabolic rises … isn’t it a beauty?

and here’s the update on GMCR – amazing !!! I haven’t looked at it in a couple years!

CLIFF NOTES: many, many, many charts are showing these parabolic rises … Sir Isaac Newton has yet to be proven wrong w/ his theory of gravity!