USD Index on the “watch list” for completing the “correction”

When PATTERNS fail, the almost always come back to touch it and then CONTINUE

we now have a GREAT opportunity to see if the 10000 level holds on the German Dax. I blogged about it here: http://bartscharts.com/2014/12/14/german-dax-voo-doo-is-a-wonder-to-behold/ and at the time it was finishing a MONUMENTAL pattern from the all time low 30+years ago. Guess you could say it “worked” because it held the market at that level for over a year and then it exploded higher earlier this year.

now, one of the “axioms” of PATTERN recognition is when a PATTERN fails (which it ultimately did a year later) the market will, invariably come back to touch it and then continue in the direction of the break.

yes, I know, sounds CRAZY but as a PATTERN dude, you HAVE to TRADE WHAT YOU SEE not WHAT YOU BELIEVE .. what do we have?

A PERFECT pattern on top of a former long term pattern …this is what we SEE:

- .618/.786 overlap retracements

- 1.618 extension

- projection into the area

- measured moves w/ the projection (note the blue arrows)

- ALL ON TOP OF A FORMER PATTERN

so, time for the IF then …

- IF this pattern holds then the German Dax should move higher …. perhaps even taking out the old high. I know that belief is crazy .. but it’s what I see.

- IF THIS PATTERN FAILS – it ranks up there as a “big deal” and is VERY VERY significant? Why?

- In a very strong UP trend PATTERN dudes ALWAYS trade the first pattern int he direction of the trend.

- In a directional change – that first pattern will usually fail and then, well, it’s not good so to speak and the correction will go much deeper than “they” expect.

- In a very strong UP trend PATTERN dudes ALWAYS trade the first pattern int he direction of the trend.

So, knowing that, yes, the global market is connected believe this is a VERY good proxy to see if the support holds … if it does, then believe we’ll carve out a support zone in the US markets and others ….

Stay tuned and let me know if you have any questions.

B

1856 ….

if you read my last post (here: http://bartscharts.com/2015/08/20/i-think-this-is-a-song-of-hope-robert-plant-live-stairway-to-heaven/ ) you’ll understand the importance of a “swing low.”

I’m watching 1941 – blue arrow measured move that has happened before but, more importantly, 1856. 1856 represents the largest correction down since 2009 BUT MORE IMPORTANTLY is a KEY swing low area … if we take out 1818 then this puppy could really breathe.

also, note how 1970 (close today) calendar days ago we did a plunging low in October 2010, rallied for a bit and then another climatic plunging low.

PRICE will ALWAYS equal TIME.

One last … don’t go long the equity market till the EURO starts back down …once dollar goes back UP then believe this cleanse could be complete.

Have a great weekend .. enjoy the ride.

STUDY the CHARTS and turn the TV pundit dorks off …

“I think this is a song of hope …” Robert Plant Live Stairway to Heaven

The S&P 500 has been climbing a stairway to Heaven ..

folks coming into 2015 we had some pretty strong patterns appearing. some worked and some didn’t – isn’t that what we expect? that being said, it was prudent to be cautious due to their presence.

here’s what I posted around a year ago:

“Let’s don’t jump up and down and scream the BEAR MARKET is here till this chariot of the bulls breaks a swing low.”

so, while we’ve sold off for the past couple days let’s not go crazy. we have broken ONE swing low and that’s it, and it’s ONLY a weekly. WE HAVE NOT BROKEN A MONTHLY SWING LOW.

so, keep it ALL context of the big picture. We break a swing low on a MONTHLY and then a second then we have “issues.”

but for now, EVERYONE knows this puppy was on steroids and need some shaking out so let’s look for a pattern to BUY on a weekly (hint hint – it needs to breathe a bit) and if a bear I would still be very cautious.

what do we know and see … ?

- we know a weekly swing low is about to be taken out and we’ll know that ONLY WITH THE CLOSE TOMORROW … we also know this has NEVER happened since March 2009 bull market began.

so, here’s the logic:

- if weekly close below a swing low … get defensive.

- if not, then keep in mind, we have pressure on the downside and it probably needs to breathe down so just chill …

enjoy the post below .. you’ll see some of the patterns were early, some were spot on. that’s not the point .. the entire post below is around the market action around a SWING LOW or SWING HI and to respect them — very very strongly.

let me know if you have any questions.

chart below is the ES .. note the red horizontal swing lows. those have never been broken on close. it might happen tomorrow …

Bart

As we have discussed multiple times in this venue, the move since 2009 has been one heck of a ride. This chariot of stock market emotion is, literally, off the charts. It is at an extreme that has surpassed 1929, 2000 and 2007. For the past 6 months it has defied the powerful cycles and patterns we follow. However, we are at another “potential” inflection point and based on this weeks price action the chariot appears to be running out of gas. So, objectively, the cycles and patterns we follow appear to be working. Let’s don’t jump up and down and scream the BEAR MARKET is here till this chariot of the bulls breaks a swing low.

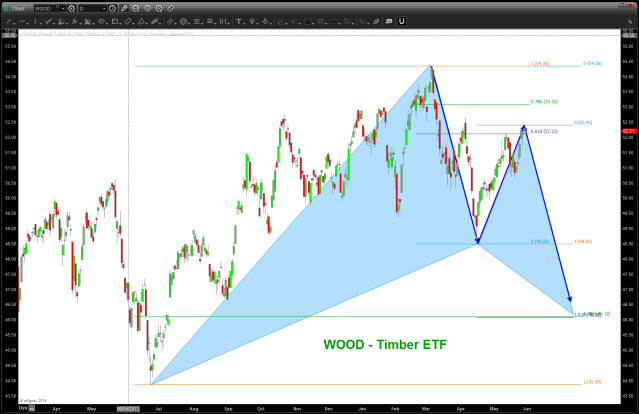

Lumber revisited

I know nothing about the harvesting techniques of wood/lumber.

The post below the two dashed lines is over a year old.

These targets were generated from harmonic pattern recognition.

Notice, there are NO oscillators, moving averages, bands or anything like that .. just PRICE and TIME.

They were all hit … sometimes they work, sometimes they don’t.

There is no “back tested” or “could of, would of, should of”

Patterns exist for only one reason … to let you know when your wrong.

What comes next? I don’t know, find a pattern …

Bart

CLIFF NOTES: below is a weekly continuous contract of the lumber futures. all the ratios come together at 241-242. this is a very nice one….stay tuned. might/could find support a little lower and then it’s off to the races in/around here but the larger pattern is very nice. appears bullish from a WOOD/CUT/Lumber Futures perspective.

“basic” technicals and waves suggest further devaluation coming on China’s currency

Crude Oil Approaching BIG low …

Was the $INTC breakout real? We’ll find out, soon …

$NFLX kicked my ass

if you look thru or have been reading my blog you’ll realize that the patterns do fail .. invariably when this occurs I’ll go back to the drawing board and come up w/ another PATTERN. check out WYNN … you never know what’s going to happen and the PATTERNS do fail. manage the risk …

$NFLX has beaten me – alot. Uncle ….

http://bartscharts.com//?s=NFLX

that being said, I hit erase all on $NFLX chart and took a fresh look at it … I still see 5 waves up w/ no RULES broken so the count is valid and there’s monthly bearish divergence and we are about to tag the upper long term trend line that is roughly 10 years old. I still say be careful up here but .. again … UNCLE.

but what’s the next pattern or set of target areas? No flipping idea …nope, not going to do it.

“f’it dude, let’s go bowling”