CLIFF NOTES: I have been a dollar bull for almost a year now and while price has made higher highs on the longer term time frame, it sure looks sick on a daily. So to the drawing board I have gone …and, while you will see a very nice an orderly count down into 5 waves, what I decided to do is label the bottom wave a (1) meaning this entire consolidation which I think has kicked a lot of people in the rear (bulls and bears) is making a big multi year triangle and it’s, ultimately, going to crack the dollar wide open. Not good …

HEADS UP – we have completed a bullish BUY pattern on the dollar index right at the multi month trendline at 79.45-79.47. But caution is warranted as the THRUST into this level is very bearish. If this pattern fails then leg “d” has begun into the 76 level, and we need to come to the realization that the dollar has potentially entered a very bearish scenario. Now, I fully expected us to be zooming away in a C wave up to the mid 90’s as shown but the C wave is described as being “a beauty to behold” or “devastating in nature” w/ thrust and momentum that GOES. Can you say that the chart is telling us that for the last 1.5-2 years it’s been a rocket ship? No chance …this has been one dead puppy. And the “visual” weight certainly looks like she might break the trend line.

here’s one look at the long term Monthly RSI w/ the bearish resistance bands on the RSI noted. As you can see the BIG POP up never transitioned above the bearish resistance zone. The RSI will tell us when the trend has changed … since the POP it’s made lower highs and just broke the trend line that had held the RSI as support …

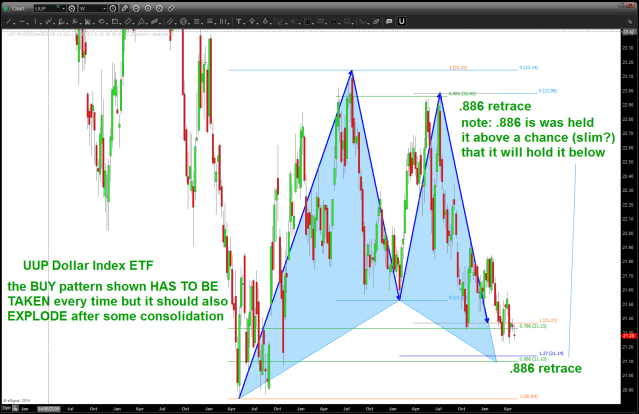

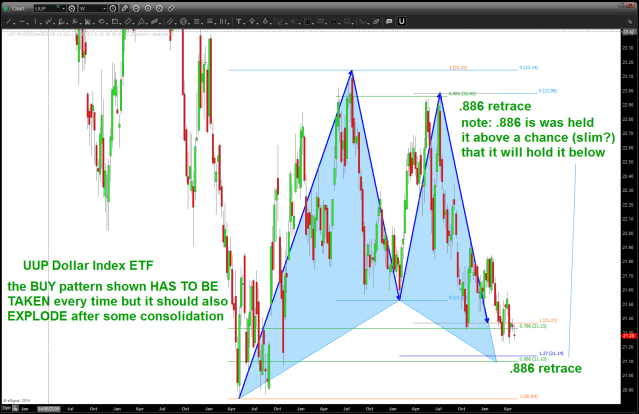

Note the UUP ETF below … folks, as far as PATTERNS go there isn’t a better set-up. NOTE the .886 retrace held it as resistance so MAYBE it will hold it as support? Either way, if we break down below 20.84 look out below. The UUP BUY was such a nice pattern.

BOTTOM LINE: watch the BULLISH BUY pattern .. with this much slumping and also the BIG CANDLES that came crashing into the pattern today if the dollar can with stand this push THEN it will be impressive. Have to put my big boy technician pants on perhaps throw in the towel on my BULLISH DOLLAR thesis that I have clung to for 1.5 years.

We’ll know in the next two days …

Bart

Like this:

Like Loading...