09/05/2016

I know nothing about the harvesting techniques of wood/lumber.

The post below the two dashed lines is over a year old.

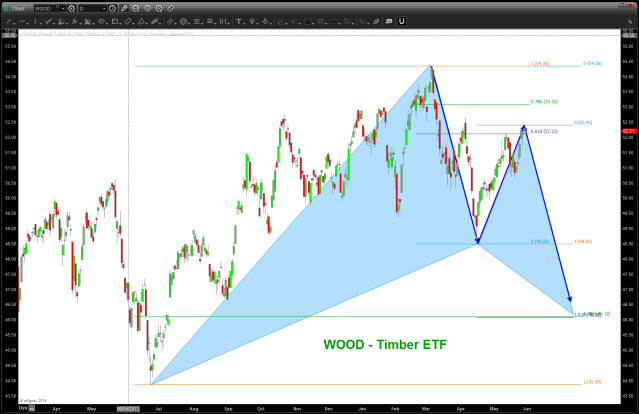

These targets were generated from harmonic pattern recognition.

Notice, there are NO oscillators, moving averages, bands or anything like that .. just PRICE and TIME.

They were all hit … sometimes they work, sometimes they don’t.

There is no “back tested” or “could of, would of, should of”

Patterns exist for only one reason … to let you know when your wrong.

What comes next? I don’t know, find a pattern …

Bart

CLIFF NOTES: below is a weekly continuous contract of the lumber futures. all the ratios come together at 241-242. this is a very nice one….stay tuned. might/could find support a little lower and then it’s off to the races in/around here but the larger pattern is very nice. appears bullish from a WOOD/CUT/Lumber Futures perspective.

Herr Bartelloni:

Biggest concern about this chart… is the price of lumber has been dislocated from reality since 2008 and aside from some price movement (the 50% draw down in 09-10…. The price of lumber futures has not reflected the reality of the cash market for lumber.

The pricing of lumber ( and most building materials) never repriced to consider two huge macro market trends.

First home building in the US ( and globally) has been in the worst decline and home production trough (as bad as the great depression). 8 years later the US market is starting to produce the volume of homes (product that requires lumber) that matches the 75 year trough BOTTOM in annual home production. Yes for 8 solid years the production and use lumber has not matched the lowest volume of lumber usage in 75 years… now we are just hitting numbers of production that would match the bottom 15% of worst years of home production and lumber usage. Yet the cost of lumber futures are pinned to all time highs… that is dislocated pricing in capital markets. If lumber pricing accelerates it will suffocate price models for construction and economic stimulation through real estate.

Second… Lumber and several other commodities futures tend to be more illiquid than say oil. Oil’s precipitous decline of 60-80% was only result of one factor (as was it’s ascent) excess investment or speculation by institutions starting in 2000. Removal of depression era laws/regulations about investing in commodities allowed the large banks to form massive commodities businesses that inflated pricing across the board. This was eventually (slowly) corrected by regulators and oil declined to historic (yet still high numbers) that more accurately reflect global consumption of the product. This happened because oil (& gas) far more liquid and represented 70% of the banks/ HF’s “commodities portfolios”. The less liquid commodities have not experienced the exit of the big bank & fund money.

Based on consumption – wood being used to make stuff. The pricing on CUT should be between $8.5-9.5, rather than $25. Agriculture is another area where the big banks and funds are liquidating over time. As it reflects a low amount of cash in the portfolio it will take years… or a global panic to dispense of these assets.

Msgr. Curran

________________________________

you my friend, are a genius!