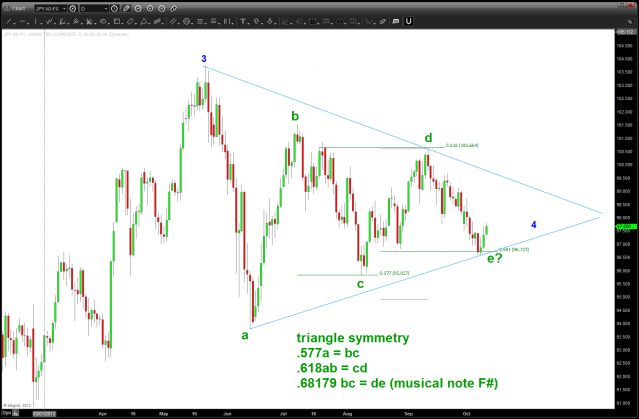

10/22/2017 – we discussed the ‘RSI SHIFT’ below. taking note of it again …have been on the sidelines w/ regards to the USD vs YEN as I’m waiting for resolution of the downtrend line shown …

note: still in the ‘maybe’ camp of 2 being done … so were going to be watching the YEN very closely in the coming days/weeks. In the past, YEN strength hasn’t been too good for US Stocks …

—————————————————————————————————————————————————————————

here’s some work that I’ve been doing on the YEN: https://bartscharts.com//?s=yen

just taking a look at the weekly RSI and, when I trained under Constance Brown she said “the market will tell you when it’s shifting, watch the RSI zones for clues.”

as you can see below … the, what I believe, multi-decade wave 5 occurred in 10/2011 and a VERY powerful advance occurred. You’ve read about my chaos w/in the YEN and how I got stopped out something like 6-8 times (I’ve tried to flush it from my memory) in around 76 ..(yes, 76! and, no one said this was going to be easy!) for what I was expecting was going to be a monstrous ride.

anyway, note how support SHIFTED up after the decades long bear trend … (see dashed green lines) and how, after this correction – which might be pretty much complete it the support and resistance has now shifted down (see dashed red lines) ….

I’m in no mans land right now .. while I believe another advance of the USD against the YEN may be forthcoming I would have really liked to see the RSI resistance SHIFT back up into the 80’s. So .. while our ‘count’ isn’t complete in this wave, I’m going to step aside and see what happens the rest of the month.

as you can see w/ the ???? it’s time to sit on my hands and see what plays out … that’s only me. you do what you want and follow our plan, as always.

Bart

Like this:

Like Loading...